This report contains a preview of our ongoing research on EPS company guidance. Some of the statistics and observations suggest this data set could have important alpha relevance and potential for helping to augment asset managers’ return objectives.

Our work has been benefiting from Earnings Per Share (EPS) guidance since the late 1990s with creation of the Earnings Predictor Model, which we re-implemented after September 11, 2001 as Smart Earnings Factor (SEF). Until recently, guidance was more commonly referred to as Pre-Announcement. Nevertheless, from the outset we used a number of parsing techniques to process one the few data sources that contained guidance, the First Call Real Time Estimate feeds, to quantify a range of company releases such as point, range, directional, and the others pre-announcements in order to create predictive earnings models.

Since that work, the earnings landscape and its productive alpha generating ability have experienced a lot of changes. The diminished effectiveness is often attributed to widespread use of earnings factors and regulatory changes enacted to protect investors starting in early 2000. The effect of the former is well documented by academics and practitioners. The following notes point to potential impact of regulatory changes on the usefulness of guidance.

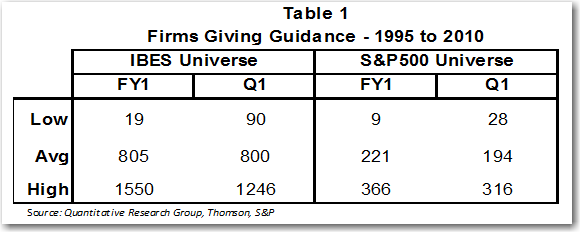

In this preview, we only address EPS guidance for next fiscal year (FY1) and quarterly period (Q1) notwithstanding many companies also guide Wall Street and investors on other measures and fiscal periods. Table 1 displays the low, average, and high statistics for the total number of firms that released earnings guidance from January 1995 to December 2010. Over that period, which covered the enactment of Regulation Fair Disclosure in October 2000 (Reg FD) and Sarbanes Oxley in July 2002 (SOX), there were noticeable changes in the volume of guidance.

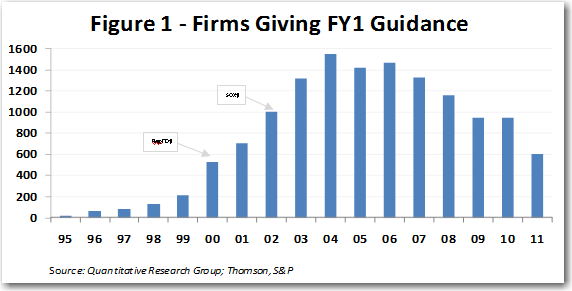

Specifically, low volumes occurred in the 1990s followed by significant increases around the enactment of Regulation FD of 2000 and the passage of Sorbane-Oxley Act of 2002. During the decade ending December 2010, the total number of firms directing Wall Street on earnings went up several folds reaching more than 1500 in 2004, according to the Thomson/IBES universe .

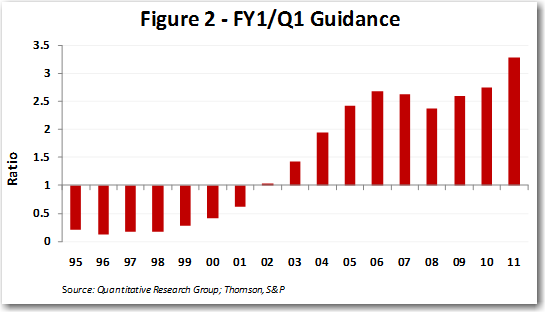

In addition to the significant growth in number of firms managing earnings, there was an important shift in the type of guidance that companies released to investors. As shown in Figure 2, most pre-announcements in the 1990s were for Quarterly information. Q1 guidance flattened in 1997 to 1998 and subsequently continued to decline through the implementation of Reg FD in 2000. By 2003, FY1 had taken the reigns and was on its way to become the dominant measure on which firms provided guidance.

Our objective in working with this data set is to create models that can be exploited in the investment process. Although this research is ongoing, we wanted to pause and share the following observations:

- The number of firms giving guidance (as well as the number of these releases) seems to be stabilizing and preparing for another period of acceleration. This is evidenced by slower rate of decline in number of firms giving guidance recently. Also, the number of firms that have posted guidance in first quarter of 2011 already represents over 60 percent of the whole of 2010 – see above Figure 1.

- The continued dominance of FY1 guidance over Q1, which started in 2003, suggests that company managers may have permanently refocused their earning management strategy from shorter to longer term.

- The late 2008 financial driven Great Recession produced an environment similar to the early 2000s which was notable for its overwhelming popular sentiments to curb corporate and Wall Street excesses. Recently, these comparable feelings were important motivation behind passage of the Dodd–Frank Wall Street Reform and Consumer Protection Act of July 2010. Similar to early 2000s, sweeping regulation could serve a catalyst that changes firms’ guidance behavior as well as fuel guidance volumes.

We look forward to providing you more updates and sharing the results of our company guidance research. In the meantime, if you would like to receive our weekly guidance report or have any questions on this preview, please contact us at 914.734.1312 or info@quantresearchgroup.com.